|

For Immediate Release

Office of the Vice President

March 22, 2005

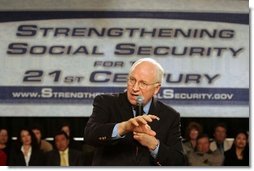

Vice President's Remarks at Town Hall Meeting on Social Security

Neil Road Recreation Center

Reno, Nevada

10:15 A.M. PST

THE VICE PRESIDENT: Well, good morning. Thank you very much. And, John, thank you for that introduction. It is true I go up and have lunch, usually every Tuesday with the Senate Republicans. A lot of people don't realize that the Vice President is really a creature of the Senate. My paycheck actually comes from the Senate. And all that goes back to when they wrote the Constitution, and they created the post of Vice President, and they got down to the end of the Constitutional Convention and suddenly realized, they hadn't given him anything to do -- didn't have any real work. So they said, well, we'll make him the presiding officer of the Senate. We'll call him the President of the United States Senate -- which they did -- and give him the authority to cast tie-breaking votes. So if the Senate is deadlocked 50-50 on a measure, then they call on me, and I get to cast the tie-breaking vote.

My predecessor, our first Vice President, John Adams, also had

floor privileges. He was actually allowed to go down into the well of

the Senate and engage in floor debates. And then he did a few times,

and they withdrew his floor privileges. (Laughter.) And they've never

been restored, so --

My predecessor, our first Vice President, John Adams, also had

floor privileges. He was actually allowed to go down into the well of

the Senate and engage in floor debates. And then he did a few times,

and they withdrew his floor privileges. (Laughter.) And they've never

been restored, so --

But it's a special pleasure to be here today in Nevada. We really do appreciate the great support we got from Nevada in last year's election campaign. It was absolutely essential, and folks really came through for us. (Applause.)

You've had some great public servants over the years. Paul Laxalt is a close friend, as is John Ensign, and Barbara Vucanovich. Barbara and I served in the House together for many years. They do great work. And the nice thing about it if you're the congressman from Wyoming is you can look at the Nevada delegation and find fellow Westerners who basically are conservative. They're right on the major issues of the day. And they're great allies to work with in those battles back there.

Wyoming, of course, is unique in the sense that we only had one congressman. It's a small delegation. I was the congressman for 10 years, and of course, it was a quality delegation in those days. (Laughter.) But we enjoyed very much -- I enjoyed my service in the Congress. And now, of course, we're embarked upon an effort to have a national dialogue, if you will, or discussion about the future of Social Security. That's what I wanted to focus on today.

What I'd like to do is make some comments up front, talk about how we perceive the problem, and some of the ideas that are floating around out there as ways to address those issues. Then I'd like to throw it open to questions so you'll have an opportunity to ask questions, and while I'd like to focus on Social Security, I'm not above answering questions on other subjects, as well, too. So I'll try to keep my remarks relatively brief, but I do want to focus as much as we can this morning on the Social Security issue.

I think everybody would agree or nearly every American would agree that Social Security has been a very good program for the American people, going back 70 years. (Applause.) It was intended to provide a basic floor of support, if you will, for our retirees back in the 1930s, coming out of the Depression, tough times. And of course, there have been millions of Americans, several generations of Americans since who've been the beneficiaries of that program. And I would guess virtually everybody here has some family member who at one point participated.

Nearly everybody, of course, participates by way of paying payrolls taxes. And while some folks now are not directly in Social Security, but have been exempted because they're involved in some of the programs, the vast majority of Americans have been, will be in the future, dependent upon Social Security for some part of their retirement.

Now, the situation as it exists today for those currently retired is relatively good. That is to say there's no immediate danger that we can't pay the checks. We had a situation like that back in 1983, when we nearly ran out of money. And we came together on a bipartisan basis, passed some measures, got them approved and put Social Security back on track for the next several years.

Social Security today for those currently retired and those about to retire will be in good shape -- that is to say, capable of paying the benefits that have been promised. The problem we have is the long-term problem that given the changing demographics of our society, that in fact, if you look up here, the chart on that side of the wall, you can see to the left, of course, this dark blue, we're in good shape. We've got a surplus there so we can pay benefits. But we get out here to about 2018, and we will, in fact, be paying out more than we're taking in. We'll be started into deficits given today's -- today's program.

The bottom line is that we have never funded the promises that have been made for future generations. If you're retired today, of if you're over 55, if you were born prior to 1950, you can relax. Everybody has agreed that the existing program will continue. Those benefits will be paid. The resources will be there to keep those commitments.

But for everybody born after 1950, we're into a situation where we need to begin to talk about how we're going to protect Social Security, and make the necessary changes and modifications to ensure that it's there for future generations.

Why do I say that? Well, just think about how the world's changed in the 70 years since Social Security was set up. In the mid '30s, average life expectancy in this country was 63. What that meant was that a majority of Americans didn't live long enough to draw benefits. You had to be 65, obviously, for full retirement. So it's -- the population today, though, if you look at our life expectancy is now almost 78. We went from 63 to nearly 78, everybody who retires, just as a general proposition, is living much longer than was true 70 years ago. And that clearly places a significant additional drain on the system in terms of benefits that have to be provided for a longer period of time.

We've also got a big population bulge about to hit retirement, the so-called baby boom generation. That ordinarily is thought of as beginning in 1946. Those born in 1946 and after, the postwar baby boom. Well, three years hence, in 2008, they're going to hit 62, that first wave of that baby boom generation. And we've discovered in recent years that over a majority -- that's over 50 percent of Americans are taking early retirement. So they're not waiting until they're 65 or 66 for full retirement benefits. They're retiring early at age 62. So that's why in 2008, we'll begin to see a growing demand obviously for benefits.

And as John pointed out, we're at a point where over time, the size of the retired population is expanding relative to the size of the work force so that we'll have more and more people drawing benefits with the smaller number of workers per each retiree to actually pay the funds that are going to generate those benefits.

Today, we've got about 40 million retirees in this country. Twenty five years hence, that will almost double; we'll have over 70 million -- about 73 million or 74 million retirees.

Again, the dynamic of that demographic changed. It's there. We know how many people are alive today. We know what age they are. We know when they're going to retire. We know what benefits have been promised. We know how much money is going to be paid in through payroll taxes over that period of time. And we know that if you're 30 years old today and you're looking at retirement, normal retirement, down the road 30-some years hence, that if there's no change in the program, you're going to see benefit levels cut 27 percent.

So when you hear somebody say, well, we shouldn't do anything, and some political figures have said that -- some have said, well, we don't need to address this issue, we shouldn't worry about if there's no problem here, they're just trying to scare you. What they're advocating is leaving the current program in place, and the current program cannot pay those future benefits that have been promised to the younger generation. And as I say, the current policy that's in place today means if you're 30 years old, there'll be a 27-percent reduction of benefits for you by the time you hit retirement age given current law.

Now, in light of all of that, we think it's important for -- to address that issue. The President and I ran in 2000 and again in 2004 with the pledge that if elected, we would, in fact, address the Social Security problem. For a long time, it's been talked about as the third rail of American politics. Touch it, and you die. We think that's not true. And the fact of the matter, I guess, that I'm here today and the President is down in, I think, Albuquerque today talking about Social Security, and we've gone through two campaigns -- one was a little close, but we got through two campaigns -- that, in fact, you can and should have this debate on Social Security, that it's our obligation, our responsibility as President and Vice President, as part of the administration that's just been reelected to say, openly and honestly to the American people, these are the facts. We've got to do something about all that red ink that's up there for the out years if we want to make certain that my kids and grandkids and your kids and grandkids are going to have the kind of confidence that, in fact, that basic floor of retirement security will be there for you when you need it.

So it's not about folks like me -- I turned 64 in January. It's about that next generation. It's about my daughters in their 30s and my grandkids now -- range in age from, I guess, eight months to 11. It's what kind of system we're going to put in place for them. And the reason to do it now is because we've got the advantage of time, instead of having to wait until the very last minute and then make radical changes. Like dropping off the cliff, we can take advantage of the time that's available now if we begin to make changes now in terms of making certain that system is going to be -- going to be okay going forward. We have the advantage of the time value of money, the ability for compound interest over time, just like your savings account. You know if you've got compounded annual interest that it will grow and we want to take advantage of that to help fund those future benefits for those younger generations.

And what the President has said at this point is that he's bound and determined to address this issue. We didn't get elected to play small ball, is the way he says it in the Oval Office, and this is a big issue that's worthy of the attention of the national government and the American people to talk about and discuss and debate and make some decisions on so that we can solve the problems that are there.

We believe that part of the solution rests with what we call personal retirement accounts. This is where a lot of the debate has occurred in recent weeks as you've listened to the dialogue in Washington. We think that it makes sense to allow the younger generation -- or, again, what I'm talking now about who would be eligible for our proposed program, it's anybody born after 1950. If you were born before 1950, this wouldn't apply to you. You'd be covered under the existing program. Born after 1950, you'd have the opportunity to take a portion of your payroll tax -- everybody now pays 6.2 percent tax on their earnings into Social Security; the employer pays another 6.2 percent, total of 12.4 percent of payroll that goes into the Social Security system -- would be allowed to take, say, 4 percent out of that 6.2 percent that you're paying in and set that into a personal retirement account.

What do we mean by personal retirement account? Well, we mean an account that has real assets in it, an account that would be similar to the thrift savings plans that John mentioned that are available now for members of Congress and federal employees. If you're a federal employee today, you, in effect, take part of your income, goes into the Thrift Savings Plan. It can be invested in one of five different funds that are available, overseen by the government. They're conservatively managed. This is not money that's going to go into a hedge fund. Contrary to what some of my friends on the other side of the aisle say, this isn't a lottery. You're not taking it to Reno or Vegas and playing the tables. It is, in fact, conservatively designed funds, broad-based, based on mixes of stocks and bonds or U.S. Treasury securities if you want to be really conservative.

The track record over the period of time that that Thrift Savings Plan has been in force has been very good, very solid, very dependable through good years and bad. And, in effect, what it does is provide a higher rate of return for the individual than you would get if you put that 4 percent into traditional Social Security.

So then when you reached retirement age, you would have -- still have a base of Social Security -- traditional Social Security, but it would be less than would be the case otherwise because that 4 percent out of the 12.4 percent has gone into the personal retirement account. But you'd have the personal retirement account, as well, and because it had earned a higher rate of return than you'd get through traditional Social Security for that younger generation, it should produce a higher level of benefits.

But it's the opportunity, in part, to have ownership of that asset that we think is vital and valuable, as well. Now, most people -- if you get out and look at the polls, I think we've reached the point where most Americans understand we do have a problem in Social Security.

I think there are -- a majority of folks in the younger age groups understand the value of the notion of a personal retirement account, that it would give them something many of them are familiar with already: We've got 401(k) plans where they work, we do have a number of employee groups around the country that in years past, have opted out of Social Security when that was possible -- public employees, state and local units of government sometimes, who are enrolled in similar plans for their retirement. So there's ample evidence there that it works and it will, in fact, produce the desired result.

Now, we have not argued that a personal retirement account will solve the entire problem. That is there are other measures that are probably going to be necessary, as well, in order to fix the long-term outlook for Social Security. What the President has done is to invite everybody into the arena. He said to members of Congress and people all across the country, come on and put your ideas on the table.

And there are a lot of them that are out there now. Lindsey Graham from South Carolina has submitted his own plan. Senator Chuck Hagel from Nebraska has put one forward. In years past, we had proposals from Pat Moynihan, a Democratic Senator from New York; Tim Penny, who was a Democratic Congressman from Minnesota. We've urged everybody to come on out, put your ideas on the table. We have not rejected plans. We don't want to embarrass anybody. Some of the ideas are good, some of them not so good, but what we've said is, come on, let's have a debate and dialogue and talk about how we're going to address that fundamental long-term problem with respect to Social Security.

And, as I say, we believe part of the solution ought to be the personal retirement accounts because we think that will provide a better guarantee long term for today's youngsters, that they will, in fact, have a real asset there, something they can count on and something that will be there once they reach retirement age.

So that's the basic pitch. We think it's about as important an issue as we face as a nation. We think it is valuable for us to have the advantage to talk about it now, to address it now, not to wait. It's always easy in this business to postpone these tough decisions and say, well, we'll let the next congressman, or the next senator or the next administration worry about it. But we lose then the enormous resource we have right now of time to get in place a program that over time for that younger generation who are going to be out there in the work force for the next 30 or 40 years to accrue real value in a personal retirement account that will help offset the fact that we haven't fully funded the promises that have been made up until now with respect to Social Security.

With that, let me stop and we've got folks in the audience in these attractive yellow jerseys. They've got microphones, and if you have a question or a comment you'd like to make, if you'll just get their attention and they'll bring a mike around to you so that you can participate in our conversation here. There are folks right in here, if you want to give them a mike.

Q I'd like to ask you a question. My nephew is going to be 18 next month. Will this affect him?

THE VICE PRESIDENT: It would if he wants it to. One part of the proposal I need to mention is that we've said it's voluntary. That is that people of the younger generation will have the option of going with a personal retirement account if they want, or they can stay in traditional Social Security if they want. So they'll have a choice. But certainly if you're 18, you would have what we think is a great opportunity to participate in the program. And our expectation would be, over time, if somebody is a little concerned up front and doesn't want to get involved right away, to watch how it operates, they may eventually find it's a more attractive option than traditional Social Security.

Also, there are a lot of details to be worked out during the course of the legislative debate, like exactly when would it begin, when do you phase it in. One thought is that we ought to start it immediately for the older ones, those born in 1950, say, to 1960. But then the second group, from '60 to '70, maybe start a couple of years later and phase it in gradually over time, makes it easier to manage from the standpoint of the federal financing. But certainly somebody 18 years old would be -- would have the opportunity to participate if they want.

Yes.

Q My question for you is, in the late 1990s, President Clinton suggested taking some of the surplus and investing that as a whole into the stock market. I'm wondering why you think it doesn't make sense to continue doing it as a whole. Why is personal investment accounts better? Wouldn't we make more money if we invested it together?

THE VICE PRESIDENT: Well, in a sense, it would be invested together in that there would be, say, five options, if we did it the way we do the thrift savings plan for federal employees. But it's a different approach when, in effect, the individual owns the assets, making the choices about how to invest it, rather than having the U.S. government come weigh in, the United States Treasury, and starting investing billions directly into the stock market, which is what President Clinton suggested.

I'd be concerned about the Clinton proposal because I think it would get to the point where the federal government has got more control over the stock market than I would like to see them have. I can see a situation where somebody might come along, for example, and try to make a political point by prohibiting certain kinds of investment by the federal government, that you could begin to get distortions in the market if you allowed the Treasury to allow some kind of political agenda to work its way into how billions of dollars are invested by the federal government directly in the stock market. I'd rather have those assets legally in the hands of individuals, of Americans that gives them the element of ownership, control over their own retirement. I think there are benefits that flow from the kind of proposal we put forward that were not there as part of the Clinton operation. I'm not a big fan of having the federal government be a direct investor in the United States stock market, U.S. stock market.

Somebody down here?

Q It's an honor to speak to you, sir. I'm just curious. Do you see our government functioning exactly this way for the future? So many obstacles in Washington, in my opinion on the Democrat side, but that's a matter of opinion --

THE VICE PRESIDENT: So is my dad. (Laughter.)

Q Well, the reason I'm saying that is, I love having you here, it's fantastic. Do you see politics taking place just like this from now on? It's fantastic -- I love it. But it seems like we should be able to have a tea party in Washington and everybody ought to be able to get together and hammer something out. But I haven't heard any of the ideas coming from a Democrat that are any -- constructive at all. And it seems like it's a pretty divisive thing going on in Washington right now, and I'm just wondering if it's a fixable problem, or is it going to be a continuous election cycle?

THE VICE PRESIDENT: Well, I hope it's a fixable problem. One of the reasons the President and I do it, we did a lot of this during the campaign and I've always enjoyed this kind of format, and I know the President does, as well, too. And if you get outside the Beltway, then you sort of engage with the nation, you talk to real people, you talk with folks who have got their feet on the ground and who aren't caught up in the heady aspects of what goes on in the Nation's Capital. What we do back there is important, but it only has lasting value to the extent that it's sort of grounded, if you will, in the nation at large.

We're out there day in and day out, talking to real people who have got real problems and real opportunities, who are building businesses, or looking for jobs, raising families, worried about their local school systems. Those are all relevant concerns for us to be engaged in and concerned about, and it's easy, sometimes, if you spend all your time in Washington, to lose sight of what's really important.

In terms of will we be able to overcome the partisan divide, I hope so. As I say, in 1983, when I was a junior member of the House and Barbara was in the House in those days, we all came together and we had -- Tip O'Neill was the Democratic leader, Speaker of the House, and Ronald Reagan was President, and we came together and put together a program that did, in fact, deal with the immediate crisis that we faced at that point with respect to Social Security. We ought to be able to do it again.

The approach we've seen publicly adopted by both Nancy Pelosi, the House Democratic leader, and Harry Reid, the distinguished Senator from Nevada, but he's also the Minority Leader in the Senate, has been initially, no. The first thing they said was there's no problem, we're not going to talk about it. I think we're beginning to chip away at that, though, because what happened next was a letter signed by a number of senators that -- on the Democratic side -- that said, we won't talk unless you give up personal retirement accounts. Well, that's a step there in the right direction in the sense that there's a hint there that they might be willing to talk. And I've had private conversations with some members of the other party off on the side, outside the glare of publicity, and so forth, and I think there are a number of members there who are eager at the appropriate time to get actively involved in it.

We've tried hard not to criticize anybody's proposal that they've put on the table, not to say absolutely not, under no circumstances, we're not willing to talk with you. And I firmly believe that the American people elect their leaders, especially national leaders, to address problems. You didn't send us back there to draw a paycheck and party all the time. That's not what national service, public service ought to be all about. And if you're not willing to take on the tough issues, then why bother to go to all of the effort that it takes to win a national election?

As I say, when the President persuaded me to run as his Vice President, it was because he wanted to go to Washington and take on big issues and do big things. And I think the American people expect that. They don't always agree with us, and shouldn't, but they ought to know that this is what we're doing, this is why we're doing it, and that their public officials, the folks they elect, ought to be encouraged to be a part of that process, not just simply say, absolutely not, we're not going to talk about it. I think we'll see eventually that there will be a number of Democratic members of Congress who will want to be part of a solution and will, in fact, participate in the process.

Yes, back here.

Q First of all, it's good to see that you're healthy, sir.

THE VICE PRESIDENT: Thank you. (Applause.)

Q The way I understand it right now, Social Security benefits can be paid out to a son or daughter of a deceased person to go to college on. And wouldn't eliminating some of these frivolous-type benefits be -- get down more to what the Social Security system was originally designed for and maybe pull it out of that hole?

THE VICE PRESIDENT: Well, it's been -- of course, the way we set it up originally, and over time, there have been provisions added, such as survivor benefits for a spouse. I think support for a child now ends at age 18, I believe, if I'm not mistaken. I've got people who can correct me if I say something in error. If you see somebody come running out, that means I said something stupid. (Laughter.)

And so, there will be a debate about how those things ought to be handled. I think the basic structure of the program that's there today, in terms of who is eligible for benefits, I think is basically sound. It might need to be tweaked a bit. It's the kind of thing that could be addressed as we go through the process of reforming the system here in passing the major legislation.

But the bottom line, more than anything else, is driven by demographics. Disability also plays an important part of this. Remember, we pay federal disability through the Social Security system. And about 30 percent -- I think it's close to 30 percent of the benefits that are paid out these days go to people who are drawing benefits because they've been disabled. Now, that's an important consideration as well, too, that would have to be looked at as we go forward, although the proposals we've been talking about don't affect disability directly.

I think, as I say, if you would ask the American people if there was a program out there they support, that there's probably as big a majority for supporting Social Security as a concept, as a program, that -- as there is for anything else the federal government does by way of domestic activities. And I think that's good. But that places an extra burden on those of us who want to address these issues, that we need to make certain we do, in fact, fix it and preserve it for future generations.

Way back there.

Q Good morning, Mr. Vice President. You say that roughly a third of what we would be inputting as far as the gross Social Security input would be designated for the personal retirement account. One first question is, is how come if the thrift accounts traditionally perform so well over a long period of time, why wouldn't that percentage be greater? And what are some of the other problems presented with the potential downfall of the Social Security being able to pay out in the future? You say the personal retirement accounts may be one function of solving the problem, but what are some of the other issues at hand that could affect the performance of Social Security in the future?

THE VICE PRESIDENT: Well, on the first part, in terms of what percentage is set aside, that's subject to debate. There's no absolute magic. What we've proposed was 4 percent phased in over time. There are proposals -- Congressman Ryan from Wisconsin, for example, who is actively involved in this debate, has a proposal for a 6-percent investment, in effect, of the personal retirement account.

All of that, the size of the retirement account and how fast you phase it in has financial consequences, in terms of how you manage this transition to personal retirement accounts. And the -- so the question really, in terms of the ability of markets to absorb those kinds of investments, how fast you do it, what impact that has on the short-term deficit, those are all considerations that would go into deciding whether you want to start at 2 percent, as some suggested, or 4 percent, whether you want to start it all in '06, or phase it in so it isn't fully engaged until three or four years down the road. Those are all debates we're having and that we'll have to have as the program comes together. And so those considerations, say, of how you fund it and finance it, are -- will also affect the size of it.

But the bigger you go, obviously, with respect to that personal retirement account, the bigger base you've got, the more you're going to earn over time, and the better you're going to do from a financial standpoint, in terms of the return to the individual. And so that enters into it as well, too. But it also -- the bigger it is up front, the bigger impact you have on the short-term deficit.

But something to keep in mind here, that a lot of people don't understand or haven't focused on, we already owe the money, if I can put it in those terms. We're already committed, over the next 75 years, to pay out, I believe it's about $5.4 trillion in Social Security benefits. Now, about $1.7 trillion of that is in the so-called trust fund; that is, money -- that's money that's been collected that's not there as cash at this point. As John pointed out, it's an IOU, big file drawer full of IOUs out in West Virginia someplace. But that is the -- what's in the Social Security trust fund today. And then there's about $3.7 trillion in benefits that we're committed to pay over the next 75 years but that haven't been funded. That's that gap up there, it's another way to look at it, the red ink.

The fact of that, of a personal retirement account, one way to think about how to fund it, is what you're doing is bringing some of that debt forward. It's now off the books; you're going to put it on the books. You bring it forward to fund those personal retirement accounts in the early years so that there's actually cash buildup there, asset there that people have got going forward. But the total impact on the overall deficit of the federal government is unchanged. There's no net increase in debt, in terms of what the federal government owes for Social Security, by virtue of the kind of proposition that I just talked about. In effect, what you're doing is paying it now instead of paying it later, and you're paying it in the form of what will be invested in the personal retirement account for those who participate in personal retirement accounts. But, say, the net liability of the federal government, it is already there. We've already promised to pay those benefits over time. And so we're -- it's a question of taking it off the books, putting it on the books, and moving forward on a discounted basis, a debt that's already owed. It's a little bit like paying off your house mortgage early, you may think -- is another way to think about it. It's going to cost you a little more up front; long-term, you've still got to pay for the house.

MODERATOR: Ladies and gentlemen, this will be the final question of the day.

THE VICE PRESIDENT: Come right over here.

Q Good morning. I'm a great-grandmother, and I have an extended children. And I hope to live past 90. But I was wondering, with the Social Security now, when I die, that stops. If my children and grandchildren, great-grandchildren put into this account, their private account, do they -- are they able to give an inheritance to their children?

THE VICE PRESIDENT: Yes, if there's money left in the account, when you die, that's something you can pass on to your heirs. It will be part of your estate. Another way to think about it, too -- (applause) -- we have a lot of people in this society who die before they reach retirement age, and we're talking about averages and medians and so forth here. If you work for 40 years and pay into Social Security, but die before you reach, well, let's see now, I was born in 1941, I think retirement age now for me is something like -- I don't know 66 and 8 months, or something like that. It's gradually going up over time, partly what we did back in '83. But if you die before you can start to draw benefits, that's it. You're obviously never going to see a dime of what you've paid in over time.

If you're married, you got a spouse, they'll receive survivor benefits for a period of time, but you're never going to get a return out of what you paid into the system for maybe 40 years. And that's especially a factor that affects our minority population. Life expectancy, for example, among African Americans and Hispanics is less than it is for others. They get a worse return, if you will, out of Social Security than others because they don't live long enough to draw the benefits that was equal what they've paid into the system over time. So it is an important consideration.

What we're talking about with personal retirement accounts, that's a real honest to goodness asset. You own it. And you draw on it for retirement, when you reach retirement age. To the extent that there's anything left, that's something that would go on, go to your heirs. Of if something happened to you, and you died before you've reached retirement age, that's still an asset that would go to your survivors. So it's a very different way than the way Social Security operates today. We think it's an important attribute of the program, and one of the reasons that makes this good sense to us.

Well, let me -- they're telling me I've got to get on down the road. Let me thank all of you for coming this morning. We appreciate your willingness to spend some time on this issue to the extent that you can get involved in the debate and encourage your folks to focus on it, and think about it, and engage with us. Again, I can't emphasize strongly enough how important it is for folks to recognize what we're really talking about here on the personal retirement accounts, in particular, is on that younger generation.

Somebody yesterday at an event we did down in Bakersfield -- Bill Thomas, who is Chairman of the Ways and Means and I did an event like this down in Bakersfield. And somebody in the audience asked why AARP was opposed to what we were suggesting. And I pointed out to them that you've got to be 50 years old to be a member of AARP. And for most members of AARP, this isn't going to have any impact on them whatsoever. They're in that group born for the most part before 1950, and they are, in fact, going to be covered under the existing program without changes. It is their kids and grandkids that are the ones that are affected by this.

And so I urge AARP to remember what's at stake here. Nobody is out to "destroy Social Security." Our mission is try to protect it and preserve it so it's there for future generations, so my kids and grandkids can count on it. After all, they'll be expected to pay into the system throughout their entire working lives, and it's only fair that they should believe that there'll be something there when they need it.

And so if somebody tells you that the advocates of reform here are trying to do in Social Security, don't believe them for a minute. The President and I got a lot of things we could do besides go bang away at the Social Security issue from border to border. And we enjoy the fray, or we wouldn't be in the business, but it is a very important piece of work. And so we'd urge all Americans to pause and reflect and think about it. And as I say, come on into the arena and join us in the debate. And let's see if we can't do something for our kids and grandkids.

Thank you very much.

END 10:52 A.M. PST