- Afghanistan

- Africa

- Budget Management

- Defense

- Economy

- Education

- Energy

- Environment

- Global Diplomacy

- Health Care

- Homeland Security

- Immigration

- International Trade

- Iraq

- Judicial Nominations

- Middle East

- National Security

- Veterans

|

Home >

News & Policies >

March 2005

|

For Immediate Release

Office of the Press Secretary

March 10, 2005

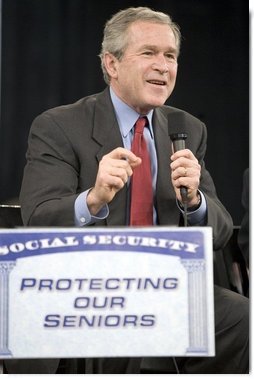

President Participates in Social Security Conversation in Alabama

Auburn University

Montgomery, Alabama

3:35 P.M. CST

THE PRESIDENT: Thanks for coming. I'm honored to be here on the campus of Auburn University in Montgomery, Alabama, what a great place. (Applause.) And I want to thank Guin Nance and all the good folks for helping to set up this trip. It's not easy to welcome our entourage -- it seems to be a little bigger than the last time I came here. (Laughter.)

I've got great, fond memories of Montgomery. We were just talking

backstage about the Elite Caf . (Laughter and applause.) Hank

Williams' grave. (Laughter.) Somebody said maybe my old friend, the

old former mayor, Emory Folmar will be here. (Applause.) Is he here?

(Applause.) Emory, how're you doing? (Applause.) I see some of the

Blounts here. I remember working for Guin's daddy.

I've got great, fond memories of Montgomery. We were just talking

backstage about the Elite Caf . (Laughter and applause.) Hank

Williams' grave. (Laughter.) Somebody said maybe my old friend, the

old former mayor, Emory Folmar will be here. (Applause.) Is he here?

(Applause.) Emory, how're you doing? (Applause.) I see some of the

Blounts here. I remember working for Guin's daddy.

Anyway, thank you all for coming. We're going to talk about Social Security and there's no better place to do it than on a college campus. Because college kids need to pay attention to this issue, and I think you'll know what I mean after I've finished talking.

Before I get into the subject, I want to first say that I'm sorry Laura is not with me.

AUDIENCE: Awwww!

THE PRESIDENT: That is generally the reaction. (Laughter.) Which sometimes I interpret to mean, we wish she was here and not you, but nevertheless -- (laughter.) She's doing great. She is a fantastic wife, a wonderful mother and a great First Lady for the country. (Applause.)

Speaking about First Ladies, it's good to have the First Lady of the great state of Alabama here, and she brought her husband, the Governor. Good to see you, Riley. (Applause.) I knew Riley as a congressman and I told him, I said, if you get elected down there you're going to love being the governor. It's a great job, isn't it? And you're doing a great job; good to see you. Thank you all for coming. Making tough decisions. (Applause.)

I'm proud of your congressman, Mike Rogers. Mike, thank you for being here. (Applause.) And thanks for bringing Beth. I want to thank the Attorney General, Troy King, for coming. I'm glad you're here Troy. You don't look old enough to be the Attorney General. (Applause.) I want to thank the State Auditor, Beth Chapman, for coming. (Applause.) I want to thank the State Treasurer, Kay Ivey. (Applause.) I thank all the state and local officials who are here, really appreciate you coming.

I've got some things on my mind. Before I get to the subject at hand, I do want to thank Woody Woodcock, who came out to see me today. Some of you may not know Woody. Where are you, Woody? Somewhere. Oh, there you go, Woody. Good to see you. Thanks for coming. (Applause.)

Let me tell you why I asked Woody to come. You're not going to believe this but he has spent 7,000 hours on adult literacy in Montgomery, Alabama. (Applause.) This is a guy who's taken time out of his life to help somebody learn to read. I can't think of a greater gift and a better way to serve your community. And the reason I bring this up is because the strength of this country is the hearts and souls of our people. We got a great military. We'll keep it that way. We've got a strong economy. We'll keep it that way. But those aren't the strengths of America. The strengths of America are the fact that there are millions of people across our country, like Woody, who are willing to take time out of their day to feed the hungry, provide shelter for the homeless, mentor a child, mentor an adult, put their arms around somebody and say, I love you, what can I do to help you. And if you want to serve our country, be one of those soldiers in the army of compassion to make America a better place. (Applau

It's an exciting time around the world. It must be amazing for

college students to pick up the newspaper and see there was an election

in Afghanistan after years of tyranny. (Applause.) There was an

election in the Palestinian Territory where the candidate said, let's

live side by side with Israel in peace. There was an election in the

Ukraine. There was an election in Iraq -- (applause) -- where the

terrorists had declared that democracy could not prevail. Yet,

millions went to the polls.

It's an exciting time around the world. It must be amazing for

college students to pick up the newspaper and see there was an election

in Afghanistan after years of tyranny. (Applause.) There was an

election in the Palestinian Territory where the candidate said, let's

live side by side with Israel in peace. There was an election in the

Ukraine. There was an election in Iraq -- (applause) -- where the

terrorists had declared that democracy could not prevail. Yet,

millions went to the polls.

It must be amazing to see how powerful freedom is for you. I've always believed it. I'm a little older, so I've had a little chance to absorb -- absorb the sense that -- the concept that freedom is universal and freedom is powerful. But you're getting to watch it. And that's important, because free societies will be peaceful societies. We're still in a different kind of war, and the way to win this war long-term is to help people realize the great call of freedom that's very deep in their soul. Freedom is on the march, and the United States of America will use our influence to continue to make this world more free and more peaceful. (Applause.)

More people are working now in America than ever before in our nation's history, and that's good. We've overcome a recession, we've overcome a terrorist attack, we've overcome corporate scandals, we'll overcome war. We've overcome a lot because the entrepreneurial spirit in this country is strong.

The unemployment rate is Alabama is 5.3 percent. Congratulations, Governor. (Applause.) Actually, you only get partial credit. The credit goes to the entrepreneurs and dreamers and risk-takers and doers. (Applause.) And our job in government is to create an environment in which people are willing to take risk.

Yesterday, I was in Ohio talking about the need for the Congress to

get an energy plan to my desk. I submitted a strategy in 2001. And I

said, listen, we got a problem. We're importing too much -- too many

hydrocarbons from overseas. The supply and demand is getting out of

balance. You're seeing it at the price of the pump right now, what I

was talking about. I said, we need to encourage conservation. We need

to encourage use of renewable sources of energy, ethanol and

biodiesel. We need to do smart things with taxpayers' money to

encourage the growth of new technologies.

Yesterday, I was in Ohio talking about the need for the Congress to

get an energy plan to my desk. I submitted a strategy in 2001. And I

said, listen, we got a problem. We're importing too much -- too many

hydrocarbons from overseas. The supply and demand is getting out of

balance. You're seeing it at the price of the pump right now, what I

was talking about. I said, we need to encourage conservation. We need

to encourage use of renewable sources of energy, ethanol and

biodiesel. We need to do smart things with taxpayers' money to

encourage the growth of new technologies.

When I went up to Columbus, I visited a research facility and talked to a person who's in charge of developing a zero-emissions coal-fired electrical plant. It's going to happen. We need to do something about our electricity grid. And, yet, they've been debating for four years. It is time for Congress to stop debating about energy and get a good energy bill to my desk. (Applause.)

We need more legal reform in Washington. Did something on class-action lawsuits which will help make sure this economy continues to grow. I think they're going to get something done on asbestos. (Applause.) And for the sake of good health care, Congress needs to get me a medical liability bill so we don't run good doctors out of practice and run up the cost of medicine. (Applause.)

I want to talk about Social Security. First thing is, people are saying, gosh, I'm surprised he's even willing to talk about the issue. You remember, it was called the third rail of American politics; you talk about it and you make suggestions about it, sure enough, the next thing you know there will be a blizzard of TV ads trying to run you out of office. It was used -- Social Security was used in a lot of campaigns to frighten people. You know, well, if he's talking about reform, that means a senior is not going to get his check. But I'm talking about it because I believe the job of a President is to confront problems and not pass them on to future generations and future Presidents. (Applause.)

And I'm about to tell you we got a problem. We got some panelists here. I think you're going to find the conversation to be interesting. We've got a granddad and a grandson, a granddad and granddaughter. And the reason I've asked them to join us is because this is a generational issue we're talking about. Social Security is a vital system, and Franklin Roosevelt did a good thing in putting it in place. It provides a safety net for a lot of citizens, and it worked for a lot of years. But it's not going to work in the out years because the math has changed.

Let me tell you about the math. This is a pay-as-you-go system. Money goes in and money goes out. There's no such thing, by the way, as a Social Security trust. Some people probably think that the government has taken your payroll taxes and held it for you and then when you retire, they give it back to you. That's not what happens. (Laughter.) The government takes your money and spends it on other things and puts an IOU, a piece of paper, on your behalf, which may be worth something, and it may not be worth something.

The math is this: baby boomers like me are fixing to retire. I will be retirement age -- of retirement age in 2008. It's coincidental, isn't it? (Laughter and applause.) That doesn't mean I'm going to quit working. (Applause.) I'll be eligible for Social Security. That's when I turn 62. And I'm the leading edge of a lot of other people. The baby boomers are getting ready to retire. And there's a lot of us. And we're living longer years than before. And that's good. It's good that we have a healthier society. We're making better choices. If you want to live longer, exercise, by the way; make good choices about your body. We're living longer and we have been promised greater benefits than the previous generation. In other words, people ran for office, said, vote me, I'll increase your Social Security benefits. That's what happened.

So start thinking about the math: more people, living longer, getting greater benefits, and fewer people paying. In 1950, that chart will show you, there was 16 workers to one paying into the system. And, therefore, if the average pay out for Social Security would be $14,200 -- that means each worker would be paying $900 a year to support that one retiree. That's manageable. Today, it's three workers to each beneficiary. Therefore, the cost is now up to $4,700 per worker. Soon, it's going to two workers per beneficiary -- and that's assuming the benefits stay at $14,200 on average.

In other words, you've got fewer people paying into the system. And the system, which was a great system, now needs to be modernized because if we don't, the money going out -- which you can see on this chart -- will be greater than the money coming in starting in 2018, and it just perpetually declines. Our government can't afford that. You see, because baby boomers like me are retiring and fewer people paying in, the system goes into the red starting in 2018; 2029, it's $200 billion short -- that's short after payroll tax. So you've got younger workers paying in, trying to pay for me, but the government isn't being able to make its promise. And that's the problem. And it's a problem we've got to address, because the closer we come to 2018, when it starts in the red, the harder it is to solve the problem.

Now, we've tried to solve this problem before. In 1983, Congress came together and said we've got to make sure the safety net works. And they said, we'll put a 75-year plan out there -- this was in 1983, President Reagan brought Republicans and Democrats together -- which, by the way, is a good model for President Bush; that it's going to take Republicans and Democrats to come to the table, and I expect both parties to be at the table. But they said, you know, we'll get a 75-year fix on Social Security in 1983. Well, it didn't last very long, did it?

See, what we need to do is address the root cause, the demographics, which have shifted, and fix this system permanently. And that's why I've come to Montgomery, Alabama -- (applause) -- and that's why I'm going to Tennessee tomorrow, I'm going to Louisiana. And that's why I'm going to travel next week and the week after that and the week after that. I'm going to make it clear to the American people we have a problem. (Applause.) And I'm also going to make it -- say it as plainly as I can, I don't care what the TV ads say, I don't care what the pamphlets say. If you've retired or near-retirement, the government will pay you what we've said we'll pay you. That's reality. (Applause.)

I was talking to Rogers about this. He said, there's a lot of people in my state who rely solely upon Social Security, and I understand that. A lot of people in my state, too. People who count on that Social Security check coming in every month. It's an important part of their retirement. And I assured the members of Congress, and I've talked to them, I understand why somebody would get nervous when they're talking about Social Security. Because somebody is saying, really what he's going to do is he's going to take away your check.

And so it's going to be an important part of this campaign around the country to make it clear to those who are receiving their Social Security check, nothing changes. Nothing changes. And when I convince people of the truth -- it's a lot easier to convince people of the truth, by the way -- when I convince them of the truth, then the American people, particularly younger folks, are going to start saying to those of us who have been elected, you said we got a problem and we believe you; the seniors don't have anything to worry about -- what you going to do for us? What are you going to do for younger workers who are going to have to pay the burden for a system that needs to be modernized? (Applause.)

I'm saying to the members of the United States Congress, let's fix this system permanently, no band-aids. Let's do our duty. And I believe that when this debate gets moving hard and people get educated about the realities of Social Security, woe be to the politician who doesn't come to the table and try to come up with a solution. There's too much politics in Washington, D.C. (Applause.) People need to negotiate in good faith. There's too much, well, I can't do it for the sake of my political party. People in both political parties need to come together and fix this for the sake of America, first and foremost. (Applause.)

In my State of the Union address, I did something the President, I don't think, has ever done, and that is said all options are on the table. I said if you've got a good idea, bring it up; let us hear it. You know, a lot of times, people would lay out an idea on Social Security and try to trap somebody, politically trap them so that you can then get them. But I said to the Congress, if you've got a good idea, come on with it. Let us hear it. And I've got some good ideas, myself, in order to permanently fix Social Security. And one interesting idea that needs to be a part of a permanent fix -- because it, in itself, is not a permanent fix -- is to let younger workers take some of their own money and set it aside in a savings account.

Now, let me tell you why I think this is an interesting idea. First of all, I like the idea of people owning something. I think we need to develop and encourage ownership in our society. Do you realize the home ownership rate is at an all-time high in America? More minorities own a home than ever before in our nation's history. (Applause.) And that's positive. It's incredibly good news. I love the fact, when I meet people from all walks of life, who say, I own my own business. I want people saying, I own and manage a part of my own retirement account. But that's not a new concept. It's happening already. When I was young, I didn't know anything about 401(k)s because I don't think they existed. Defined Benefit Plans were the main source of retirement. Now they've got what they call Defined Contribution Plans. Workers are taking aside some of their own money and watching it grow through safe and secure investments.

As a matter of fact, the concept is such a good idea that the federal government allows federal employees to do just that. In other words, they say, you can take some of your employment money and set it aside in an account of stocks and bonds. The reason the federal government lets employees do that is because the federal government understands that when you save in stocks and bonds, that the rate of return over time, the compounding rate of interest, will enable your money to grow substantially more than if the government holds it for you. It's a smart thing to do, to let federal workers do that.

I remember when a fellow that was working at the White House said, I heard you talking about personal accounts and Social Security. He said, I love my Thrift Savings Plan. Now, he's not the investor class. He's a fellow I don't think went to college. But the reason I bring that up is there's an attitude among some people in this country that only certain people can invest. That's not what I think. I think everybody in America should be allowed to take some of their own money and set it aside and watch the money grow in safe and secure investments. (Applause.) I don't think there is such thing as an investor class, limited to certain people. I don't believe that.

Now, you can't take you money under this idea and put it into the lottery. (Laughter.) That's not safe, with all due respect. (Laughter.) You have a lottery? It's not safe. (Applause.) Got one in Texas. Anyway, you can't take it to the track. Got a track? No, no. (Laughter.) You can only put it in safe and secure stocks and bonds. And you hold it for time.

Another good part of this plan is that a permanent fix will mean younger workers probably aren't going to get the promise the government has made. We can't afford it. But because of the compounding rate of interest, if you start saving money early, your asset base will grow. And that asset base, along with whatever the government is going to pay you, becomes the basis for your retirement. And you withdraw, on a regular basis, interest off of your capital.

Now, let me give you an idea of what I'm talking about. If you're a worker who has made $35,000 over your lifetime, and the government says you can set aside 4 percent of your payroll taxes into a personal account, and you invest in safe and secure stocks and bonds, by the time you retire, your personal savings account will be worth a quarter a million dollars -- $250,000. And that's yours. If you've averaged more money over your lifetime, the money goes up exponentially. And it's your money. It's your money you can retire on. But if Social Security is just a part of your retirement package, and you feel comfortable, it's your money you can give to your children or your grandchildren.

Now, we're going to talk an interesting story about what happens to some people here who die earlier than expected and what it means for Social Security. If that were to happen, you can pass that on to your widow. There's a lot of benefits with this idea, and it's a new idea. It's not a new idea when it comes to investing. It's not a new idea when it comes to what's happening with 401(k)s or with the federal government. But it's a new idea for Social Security.

It's a way to make sure that Social Security is complemented with more money available for the workers. And that's an idea I want Congress to seriously consider. I think it's an idea that makes a lot of sense, and I'm going to continue talking about it.

I've asked Jeff Brown to join me. He is a professor. He can tell you where -- where do you profess? (Laughter.)

DR. BROWN: I have a PhD in economics, and I teach at a business school.

THE PRESIDENT: Yes. It's an interesting lesson here, by the way. He's an advisor. Now, he is the PhD, and I am a C-student -- or was a C-student. Now, what's that tell you? (Laughter and applause.) All you C-students at Auburn, don't give up. (Laughter and applause.)

All right, I try to have an expert on these panels so that people think there's somebody else who believes we've got a problem, other than me. (Laughter.)

* * * * *

THE PRESIDENT: Yes, 13 years is -- if you think in two-year cycles, 13 years is a long time. But I don't think in two-year cycles. Thirteen years is really quick. How old are your children?

DR. BROWN: My oldest is seven, on down to one.

THE PRESIDENT: Yes. That's right around the corner, by the way.

DR. BROWN: I do know.

THE PRESIDENT: Yes.

DR. BROWN: Yes, 13 years, my oldest will be in college, so it's not very far away. And so what we need to do is think about ways to change the system to help us individually, as well as a country, to save more, because when we all save more, it's not just ourselves that benefit from that, but the economy benefits. When there's more savings, there's more investment. When there's more investment, people's wages go up. So this is -- changing the system to make it more of an investment-based system can really be good for long-term --

THE PRESIDENT: Yes, you understand what he's saying about this. There's a macro-economic effect when we encourage savings. When there's savings available, it means capital is available. And capital is what fuels the growth of small businesses. Capital is what fuels productivity increases. Capital is what makes a capitalist society work. (Applause.) Anything else?

DR. BROWN: It's up to you.

THE PRESIDENT: Keep going. (Laughter.)

DR. BROWN: As I said, I'm a professor, so I can keep going as long as you want me to. (Laughter.)

THE PRESIDENT: A funny professor. (Laughter.)

* * * * *

THE PRESIDENT: Glad you came, Professor.

DR. BROWN: Thank you. (Applause.)

THE PRESIDENT: You ready? Got to speak close. All right, we've got George Wood with us. George, thanks for coming. And by the way, George Wood Moody -- is that right? George Walker Bush, George Wood, George Wood Moody. (Laughter.) G.W., W. -- thanks for coming. (Laughter and applause.)

Ready to go? Why are you here?

MR. WOOD: I'm 79 years old. I fully expect to retire sometime within the next 25 years. (Applause.) Professionally, my partner, Todd Parsons, and I work with Synovus, and part of what we do is work with people to arrange their finances for retirement.

* * * * *

THE PRESIDENT: Well, you know investments. I mean, people -- one of the -- you hear people say, well, you know, investing in conservative stocks and bonds is risky. That's kind of an oxymoron isn't it?

MR. WOOD: If this had been going on during the Depression, you would still be way ahead of the game.

THE PRESIDENT: You hear that? If you hold stocks and bonds for a long period of time, even if you go into depression, the rate of return over a period of time, is pretty good, wasn't it?

MR. WOOD: Mr. President, I admire you for your courage and foresight in taking this problem on now. (Applause.)

THE PRESIDENT: Well, thank you. Thank you.

MR. WOOD: I feel -- I feel that you could very easily have swept this under the rug and say, I have only four years to go, I'll let some future President and Congress then tackle the problem.

THE PRESIDENT: Well, thank you. I wouldn't have been able to live with myself. (Applause.)

MR. WOOD: Well, I think this shows something of your wisdom, your courage and foresight in meeting this problem head-on, and thank God for you.

THE PRESIDENT: Well, thank you, George. Thanks for saying that. Good job. (Applause.)

George Wood Moody. You ever heard of him?

MR. WOOD: He is one of my grandchildren, and he's made me promise that I would behave myself today. (Laughter.) And so far, Mr. President --

THE PRESIDENT: You're going a good job. (Laughter.)

MR. WOOD: Have I not behaved myself?

THE PRESIDENT: Very well. I'm a little disappointed, frankly. But anyway -- (laughter.)

All right. George Moody, age 22, sitting on the stage with his grandfather and the President of the United States in front of a couple of thousand people. How about it? (Laughter.) Life doesn't get any better than that, does it? (Applause.)

MR. MOODY: I wasn't nervous until you said that, Mr. President. (Laughter.) Like you said, I'm 22 and the work force.

THE PRESIDENT: Going to school?

MR. MOODY: Go to Auburn.

THE PRESIDENT: Yes, good.

MR. MOODY: War Eagle. (Applause.)

* * * * *

THE PRESIDENT: Let me ask you something, anybody like your age even worry about it?

MR. MOODY: Well, of course they are. It's not something that's on the forefront right now, but they know that something has to be done in the near future.

THE PRESIDENT: Yes, somebody told me one time the younger Americans -- they took a poll of them, and said some of them feel like they're more likely to see a UFO than they are a Social Security check. (Laughter.) That's an interesting dynamic. Seriously. That's why this is an issue you can talk about. I campaigned on it 2000 and 2004 because I fully understood that the dynamic has shifted. Once we can assure George that he's going to get his check, we need to be talking to George Moody and the 22-year-olders, because they're not going to, unless we do something.

And that's why this issue -- it doesn't take any courage. It just took the realization that there's going to be a lot of people sitting out there wondering, why did we get elected in the first place if we weren't willing to go to Washington, D.C., and try to bring people together to solve the problem?

Are you worried about investing anything?

MR. MOODY: Well, in the current system, I think you earn about a 2 percent return on what you put in. And being a finance major, I know that that's -- that's diddly-pooh. That's really -- (laughter.)

THE PRESIDENT: It's a financial term. (Laughter.)

MR. MOODY: Under your personal accounts, you can earn about a 2 percent or 3 percent premium on what you put --

THE PRESIDENT: On top of that.

MR. MOODY: And that's going to compound every year. And just -- we're going to have that much more money when we retire.

THE PRESIDENT: And that matters. It matters a lot. If you're a 22-year-old person who can save, the difference between 5 percent or 4 percent and 2 percent is a huge amount of money over time -- depending upon how much you initially start to save with. And that's an important concept for people to get.

There's a lot of -- I've talked to a lot of younger Americans who talk about looking forward to managing their own money. Again, when we were coming up, I don't remember that; I don't remember spending a lot of time worrying either about solvency in Social Security, or managing my own money through the Social Security system. But things have changed. There's a confidence level now amongst people throughout our society about wanting to watch their money grow through an interesting mix of stocks and bonds.

So I appreciate you boys being here, two George W.'s. You did an excellent job of behaving yourself. Good job. (Applause.)

Ready? Sarah Garrison Webster, tell us what you do.

MS. WEBSTER: Hello, Mr. President.

THE PRESIDENT: Hi. (Laughter.)

MS. WEBSTER: On behalf of all Montgomery Alabamians, we would like to extend our heartfelt welcome. And thank you for allowing us to be part of this town hall meeting. (Applause.)

THE PRESIDENT: Well, thank you for coming. You are an entrepreneur.

MS. WEBSTER: That is correct. Mr. President, I am 57 years old. I'm retired Department of Justice. I'm married. I have two sons -- one, 40; one, 39. Both of my sons have indicated to me that they love your plan. (Applause.)

THE PRESIDENT: Raised some smart boys. That's good.

* * * * *

THE PRESIDENT: Let me ask you something about the Thrift Savings Plan. This is a Thrift Savings Plan that has a mix of stocks and bonds?

MS. WEBSTER: Yes, sir.

THE PRESIDENT: Now, how hard was that to learn how to do that?

MS. WEBSTER: And I chose the safe plan, government bonds. (Laughter.)

THE PRESIDENT: That's all right. Well, not so safe, unless we fix the deficit. But other than that -- (laughter). We're fixing the deficit. (Applause.)

MS. WEBSTER: But, Mr. President, I'm the owner of Webster Progressive Funeral Home.

THE PRESIDENT: Small business owner, nothing better. (Applause.) I hate to -- I'm not going to ask you how business is. (Laughter.)

MS. WEBSTER: Oftentimes, I see people die and their family members are not eligible for Social Security benefits, at least some of these people. Had they participated in your plan, or if we had your plan, the monies that they would have paid into the savings plan would have been passed on to their heirs. And Mr. President, your plan makes sense to me. Why on earth would we allow someone else to have control of our monies? That is money that those people work very hard for. That is money that family people deserve. The family deserves that money. Your plan is extremely bold and progressive, Mr. President. We thank you for having the courage to be able to champion this cause.

THE PRESIDENT: Thank you. Very good. Thank you, Sarah. Good job. (Applause.)

Sarah is right. Sarah is right about the system. Think about this. You're married, you're doing well, the spouse is putting money into the system, dies earlier than expected and the other spouse doesn't have anything. The money went into the system, and until you reach a certain age, there are no survivor benefits. It just, poof, goes away. And the idea of having an asset base that you can pass on to help a younger husband or a surviving wife makes a lot of sense. It helps peace of mind. And I want to appreciate you bringing that up. Thank you very much for -- pretty darn articulate.

MS. WEBSTER: Thank you, Mr. President.

THE PRESIDENT: I could use a few lessons. Good job. (Applause.)

All right. Don Farnsworth and his granddaughter, Beth. Got it right, didn't I? Thanks for coming. I hope you find it interesting, grandparents and grandkids. The reason why we've asked them to come, this is a generational issue, it truly is. The system worked for the grandparents. The question is, will we be able to get something in place, modernize the system -- not tear it apart, not destroy it -- modernize it, reform it so it works for the grandkids.

And so, Don, thanks for coming.

MR. FARNSWORTH: Pleasure to be here.

THE PRESIDENT: You might want to use the mic. (Laughter.)

MR. FARNSWORTH: Pleasure to be here.

THE PRESIDENT: I'm glad you're here. You were a pilot?

MR. FARNSWORTH: Yes, sir.

THE PRESIDENT: Don't tell them who you flew for.

MR. FARNSWORTH: I dare not.

THE PRESIDENT: No. Want me to?

MR. FARNSWORTH: Go ahead.

THE PRESIDENT: The University of Alabama. (Applause.)

* * * * *

THE PRESIDENT: Well, thanks for coming, Don. Well done. (Applause.) No question in your mind you're going to get your check.

MR. FARNSWORTH: No, I get my check every month.

THE PRESIDENT: That's good. Well, that's what we're supposed to do.

Beth is with us. She is a senior here, and she's majoring in journalism with a minor in Spanish. Como esta?

MS. FARNSWORTH: Bien. Muy bien. (Laughter and applause.)

THE PRESIDENT: Very good. A-plus. Talk to us about Social Security.

* * * * *

THE PRESIDENT: See, it's -- again, I want to hearken back to the ownership theme. I actually put it in my inaugural address, because I believe it's such an important part of our country. The more people own something, the more people are going to have a vital stake in the future of the country. It makes sense, doesn't it? (Applause.) The more people have a piece of property they call their own, the more they're going to say, gosh, makes a lot of sense. The more people watch their assets grow, they're going to be saying, I better pay attention to fiscal policy in Washington, D.C. There's nothing that causes more participation in government than if your wealth is directly associated with the decisions of government.

The more people own something, the more it is they'll have stability in their lives. And so what we're talking about is a way to make sure the Social Security system, which has worked, and worked very well for a lot of people, will continue to work. It's going to be an interesting debate in Washington, D.C. But it's a debate that the people will effect. This is one of those debates where I do my job and get people to focus on it and talk about and go to the coffee shops, and try to figure out what they're all saying up there, people are going to say -- they're going to come to the realization, we have a problem.

And when that happens, the people of this country are going to start calling up the congressmen and women and saying, we have got a problem; why are you waiting? We have got a problem and we expect you in good faith to work with the White House to come up with a solution so we can say to our grandchildren, this system, the safety net will be there for you. The safety net has been great for a lot of folks, but it's got a hole in it. And now is the time for people who've run for office to serve our country to come together and fix that hole for generations to come.

I want to thank you for giving me a chance to be here. God bless you all. (Applause.)

END 4:20 P.M. CST